Nicholas Revelations: Pressure On Options

Orange County Business Journal

By Sarah Tolkoff

July 23, 2007

A federal probe into stock options backdating at Irvine chipmaker Broadcom Corp. has taken some wild turns of late with one likely goal in mind: pressure.

Tips leading reporters to salacious lawsuits against former chief executive Henry Nicholas are aimed at upping pressure on him as prosecutors push ahead in their options probe, according to corporate law experts.

“Pressure is the name of the game in law enforcement,” said Stephanie Martz, director of white collar crime policy at the National Association of Criminal Defense Lawyers in Washington, D.C. “It’s meant to pressure (Nicholas) to cop to something or plea out.”

The U.S. Attorney’s office in Santa Ana is looking into options backdating at Broadcom, where cofounder Nicholas stepped down as chief executive in 2003.

Earlier this year, Broadcom restated financial results for 1998 through 2005 with charges of $2.2 billion – the biggest bill so far for any company involved in the options issue.

An inquiry by Broadcom directors found Nicholas bore “significant responsibility.” Former Broadcom chief financial officer William Ruehle, who resigned last year, also is part of the federal probe.

Earlier this month, the Wall Street Journal broke news that federal investigators had broadened their probe to include a look at a civil suit against Nicholas by a former personal assistant.

The suit, and another settled in 2002 by contractors who worked at Nicholas’ former Laguna Hills home, alleges drug and prostitute use by Nicholas, as well as charges of intimidation and that he created a “hostile workplace” for

personal employees.

The suit by former assistant Kenji Kato charges that Nicholas would stay up for days, fueled by drugs. His behavior often was “erratic” and he was “regularly confused,” according to court filings.

Investigators are said to be interested in the suit as part of “an aggressive legal theory” that Broadcom failed to disclose to investors that Nicholas’ alleged drug use hindered his ability to run the company, according to the Wall

Street Journal.

Government’s Lawyer

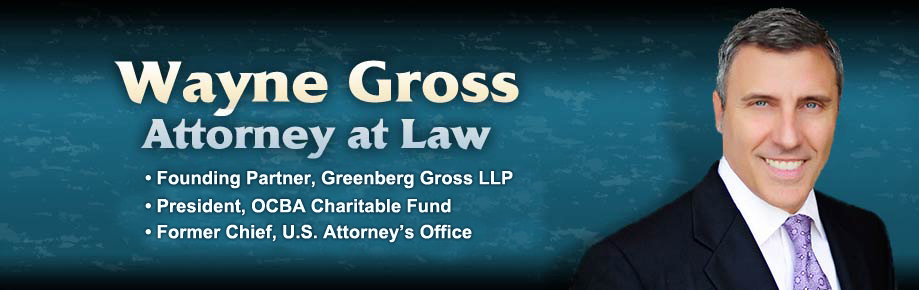

Assistant U.S. Attorney Wayne Gross, chief of the Santa Ana branch office, is heading up the investigation. He’s tried high-profile cases here, including the 1990s fertility scandal at the University of California, Irvine.

Gross, whose emphasis is on complex fraud work, serves as an adjunct professor at Chapman University’s law school, teaching about white collar crime and other subjects.

The shocking charges raised in the suits have sparked a lot of chatter around the county in the past week. But several local lawyers specializing in securities law and white collar cases declined to comment for this story. Some

cited current or past work for Broadcom.

“It’s not uncommon for prosecutors to expand their probe to other wrongdoing,” said Jim Scheinkman, partner in the Costa Mesa office of Snell & Wilmer LLP. “If they see other wrongdoing, they’re going to look at it.”

Still, drug allegations could be “hard to prove” without other evidence, he said.

The issue of what personal behavior constitutes a material concern to a company is a “cutting edge legal issue,” he said.

“The question is, ‘Is this an issue that would be material to an investor’s decision to buy Broadcom’s stock?'” Scheinkman said. “But that has to be tempered by privacy concerns.”

Nicholas, who hasn’t been charged in the options matter, refutes the lawsuit charges and denied any wrongdoing through longtime personal lawyer Steve Silverstein.

“The case is a non-event,” Silverstein said. He declined to comment on the civil suit’s bearing on the options probe, except to say he was “incredulous” that investigators were looking into it at all.

“What do these allegations have to do with the stock options backdating?” he said.

It’s likely prosecutors are looking for evidence in the civil suit that somehow speaks to Nicholas’ involvement in options backdating, said Martz of the National Association of Criminal Defense Lawyers.

“If they are turning the screws on him, it could be because they really don’t think they have gotten to the bottom of the options probe,” she said.

A potential plea deal with Nicholas would give regulators something to show for their cause after more than a year of investigating options backdating.

“There’s always a pressure point if the government starts looking into (Nicholas’) private affairs,” said Martin Goldberg, partner at Lash & Goldberg LLP in Miami. “There is an unstated hope that that may push the subject along to a favorable resolution – a plea in this case.”