Orange County pays $7 million to feds for false Medicare billing

The county admits no wrongdoing in settlement.

The Orange County Register

By Courtney Perkes

December 20, 2007

The County of Orange on Thursday paid $7 million to the federal government to settle allegations that false bills were submitted to Medicare for mental health and drug addiction services from 1990 to 1999.

The county’s Health Care Agency admitted no wrongdoing but entered into an integrity agreement intended to ensure compliance with federal regulations.

Reimbursement disputes between Medicare and state and local governments are fairly common, but it’s rare to see a false claims case involving a local government agency, said Medicare spokesman Jack Cheevers.

According to the settlement with the U.S. Department of Justice, the Health Care Agency improperly billed Medicare for psychiatric evaluations that were not performed by doctors, clinical psychologists or licensed clinical social workers.

The county also engaged in a billing practice known as “upcoding,” where brief office visits were described as more lengthy, intensive office visits in order to receive higher compensation.

Additionally, the county improperly billed Medicare for dispensing self-administered methadone to drug-addicted patients, which was not a service covered by the federal government’s insurance program for seniors and people with disabilities.

In a statement issued Thursday afternoon by the Health Care Agency, officials said the funds have been held in reserve since 2001 to cover the $7 million.

The agency said it also established a compliance program in 2000 and redesigned its billing process “to ensure that all services provided are properly documented and that billing is submitted in an accurate manner.”

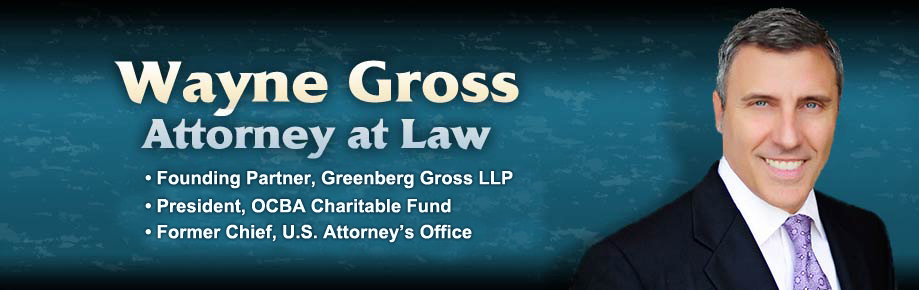

The investigation came about after an audit for Medicare found billing irregularities, said Wayne Gross, the former assistant U.S. attorney who negotiated the settlement but is now in private practice.

Supervisor Chris Norby, chairman of the board of supervisors, said the federal government originally sought $14 million. He attributed the problems to procedural mistakes.

“It was an internal glitch,” Norby said. “We got more than we should have and now we have to give some of it back.”

Thom Mrozek, spokesman for the U.S. Attorneys Office, said prosecutors did not file a civil suit against the county because officials cooperated in resolving the overpayments.

He said most health care fraud cases involve non-government hospitals and clinics but it does happen from time to time with municipal-run agencies.

Mrozek said the money was deposited into the United States Treasury.

Register staff writer Peggy Lowe contributed to this report.