Judge dismisses charge against Broadcom co-founder

The Los Angeles Times

August 3, 2009

By Stuart Pfeifer and E. Scott Reckard

In a dramatic twist, a federal judge on Wednesday cleared Broadcom Corp. co-founder Henry Samueli of a criminal charge of lying to investigators in a probe of improper accounting at the Irvine microchip designer.

U.S. District Judge Cormac J. Carney a year ago had rejected a plea bargain for Samueli because it did not allow for any jail time for the Orange County billionaire and philanthropist, who owns the Anaheim Ducks hockey team. But in a seeming about-face, Carney dismissed the felony case.

Carney took the unusual step moments after Samueli completed two days of testimony in the related criminal trial of another former Broadcom executive.

After asking Samueli to step down from the witness stand and face the bench, the judge said that what Samueli had told the Securities and Exchange Commission was “ambiguous and evasive” but not a material false statement and therefore not a crime.

Samueli bowed his head and said, “Thank you, your honor.”

The judge said he believed the U.S. Constitution’s protection against double jeopardy would bar prosecutors from refiling charges against Samueli. A spokesman for the U.S. attorney’s office declined to comment.

The dismissal of the charge will probably help heal the reputation of a man who steered the chip company from its origins in a friend’s garage into one of the most successful companies in the U.S.

“That you truly understood what happened here means a lot to me,” Samueli told the judge. “You have restored my faith in the criminal justice system.”

In June 2008, Samueli entered a guilty plea to a single count carrying a maximum fine of $250,000. Under a deal with prosecutors, he also agreed to pay a $12-million penalty. The plea deal called for no prison time.

Carney rejected that agreement a year ago, saying the unusual arrangement might create the impression that a wealthy person was buying his way out of jail. Samueli decided not to withdraw his guilty plea, but the judge dissolved it Wednesday.

The judge said at the time that he would postpone sentencing until after the trials of Broadcom co-founder Henry T. Nicholas III and former Chief Financial Officer William J. Ruehle, who were charged along with Samueli in the improper backdating of stock-option grants.

The dismissal, which came during Ruehle’s trial, silenced a packed Santa Ana courtroom. Lawyers following the case, including Samueli’s counsel, Gordon Greenberg, said Carney’s action appeared to be unprecedented.

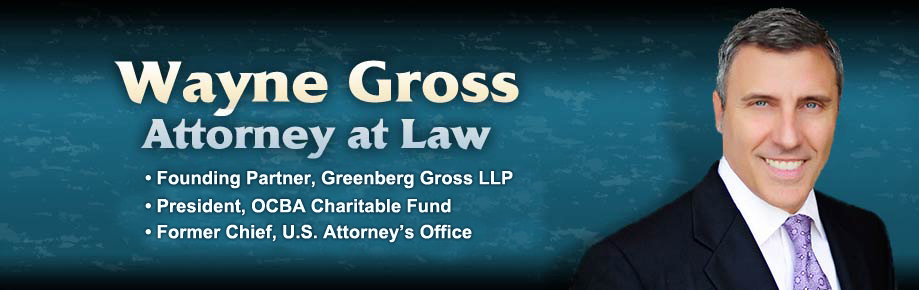

“I have never seen a judge dismiss a case against a defendant who had already pleaded guilty and who is not even on trial,” said Wayne Gross, former chief of the U.S. attorney’s office in Santa Ana and now a partner at Greenberg Traurig. “Samueli was merely a witness in someone else’s trial, which reflects the extent to which the judge was appalled. This is a remarkable and unprecedented development.”

Carney, explaining his decision from the bench, said that after listening to Samueli’s testimony he did not believe he was guilty. “I had to make this decision now because I believed justice delayed is justice denied,” the judge said.

“I’m in shock, but extremely grateful to Judge Carney,” Samueli, 55, said in an interview outside the courtroom with his wife, Susan, beside him. “I was really shaken in my beliefs in the criminal justice system.”

Susan Samueli added: “Henry’s the most ethical man I ever met. The truth came out.”

Last year Samueli, Nicholas and Ruehle were accused of engaging in a conspiracy to secretly backdate stock options to make them more valuable to employees without disclosing the action to shareholders. In a separate indictment, Nicholas was accused of supplying some Broadcom customers with drugs.

In his testimony Wednesday, Samueli acknowledged that he did make a misstatement to the SEC but said it was a mistake in recollection.

He said he had agreed to plead guilty and pay the penalty because he didn’t want to put his family through the ordeal of a public trial — or risk a prison sentence.

“It was a personal decision, based on what I would have had to put my family through,” Samueli said under questioning from Ruehle’s attorney, Richard Marmaro.

It was unclear whether Carney’s decision would have any effect on Ruehle’s trial.

After dismissing the case against Samueli, Carney said he intended to take appropriate action for what he described as prosecutorial misconduct. He did not elaborate.

Last week, the judge told the jury that Assistant U.S. Atty. Andrew Stolper had acted inappropriately in a conversation with a lawyer for former Broadcom legal counsel David Dull. Stolper, the judge said, told the lawyer that Dull could be prosecuted for perjury if he offered the same testimony as he had in an SEC deposition.

Gross, the former prosecutor, said he did not believe the judge’s decision regarding Samueli was necessarily a sign that the Ruehle and Nicholas cases were in jeopardy.

“The judge has already informed the jury there has been prosecutorial misconduct, and nonetheless is allowing the case against Ruehle to proceed,” Gross said. “As for Nicholas, the charges against him go beyond the charges against Samueli, so it seems his fate will also be in the hands of a jury.”

Broadcom was one of more than 100 companies, many of them in the technology sector, that were found to have improperly backdated stock-option grants over a number of years.

Options are rights to buy shares of a company’s stock at a specific price, usually the stock’s market price on the date that the options are granted. Backdating stock options to a date when the price was lower can increase their value to employees. The practice is not illegal, as long as it’s disclosed to investors and the extra value is reported as compensation expense, hurting the company’s bottom line.

Broadcom ultimately restated its earnings to account for $2.2 billion in options-related expenses.

Broadcom’s current chief executive, Scott McGregor, released a statement late Wednesday thanking Carney.

“Today’s decision by the court means that Dr. Samueli will continue to devote his extraordinary engineering expertise for the best interests of Broadcom’s employees, shareholders and the many other businesses that rely on Broadcom’s continued great success,” McGregor said.

Broadcom, which earned nearly $5 billion last year and employs more than 7,000 workers around the world, designs chips used in devices such as laptop computers, cable-TV boxes and Apple iPhones.

Samueli was working as an electrical engineering professor at UCLA in 1991 when he formed the company with Nicholas, a former TRW colleague. Each of them chipped in $5,000 and launched the company at Nicholas’ home, where they started working on communications devices for the military.

When the company went public in 1998, 70% of its employees became instant millionaires. Samueli, the chief technical officer, and Nicholas, the chief executive, became billionaires. Samueli used his sudden fortune to buy the Ducks and made numerous charitable contributions; his name is on engineering buildings at UCLA, his alma mater, and at UC Irvine. He also funded a library at Chapman University in the name of his late parents, who survived the Holocaust.